KYC Policies

This is an abridged version of the user guide, highlighting essential features. To access the full version with detailed steps, kindly reach out to your dedicated Account Manager.

To configure your KYC policies, navigate to Settings > KYC. You can customize the KYC requirements for different client groups, personalize the KYC form and necessary information, and configure client authentication settings to enhance security. This allows you to tailor the KYC process to your specific business needs and compliance standards.

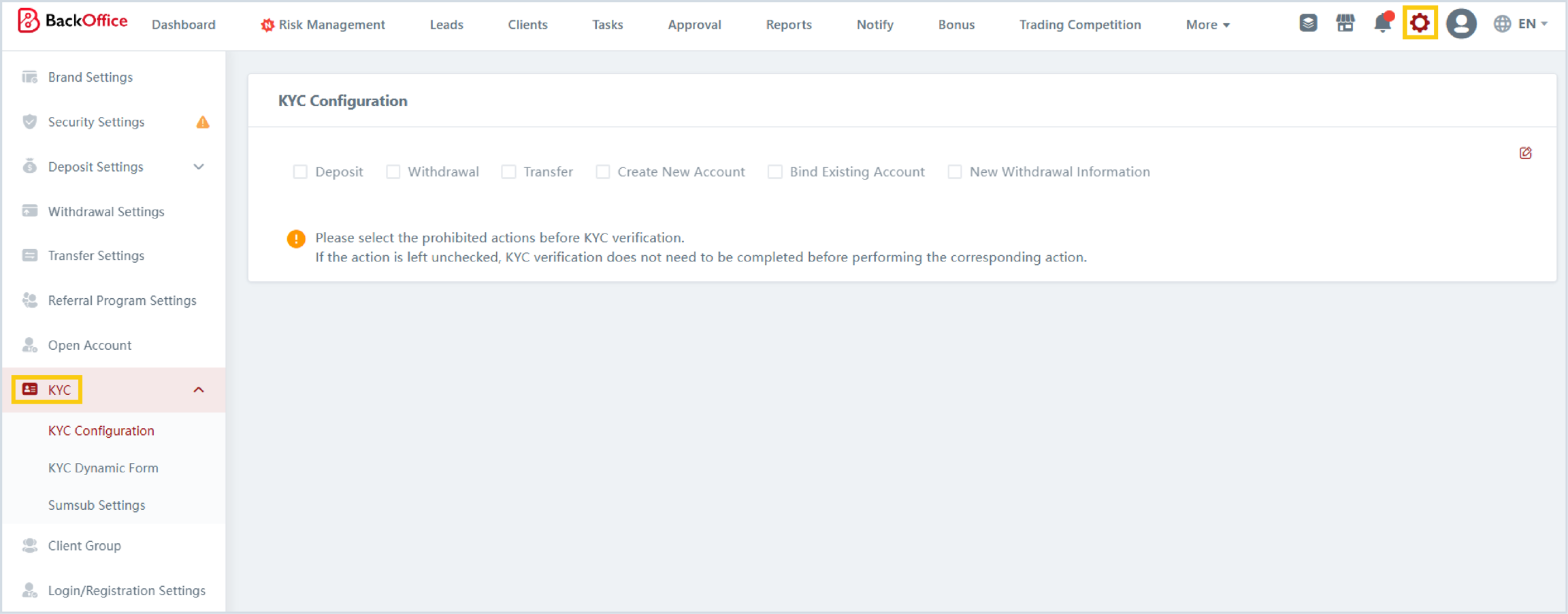

1. KYC Configuration

In the KYC configuration settings page, you can define the prohibited actions for clients who have not completed their KYC. This means that clients without completed KYC will be restricted from performing certain actions.

2. KYC Dynamic Form

In the KYC dynamic form settings page, you have the ability to create KYC forms for different client types and customize the required fields and documents that clients need to submit. This allows you to tailor the KYC process based on the specific requirements for each client type.

3. Sumsub Settings

Sumsub is a platform that specializes in identity verification and compliance solutions, particularly in the field of Know Your Customer (KYC) and Anti-Money Laundering (AML) processes. They provide tools and services to businesses that require robust verification and due diligence procedures for their clients. Sumsub offers features such as document verification, facial recognition, and risk assessment, helping businesses ensure the authenticity and compliance of their customers. Their platform aims to streamline and automate the verification process while maintaining high standards of security and regulatory compliance.

SumSub has been seamlessly integrated to the CRM, allowing you to configure an authentication process that strengthens your KYC and due diligence checks for clients. By implementing these authentication measures, you can have greater confidence in the legitimacy of your clients and mitigate potential risks associated with fraud or identity theft.

Last updated